|

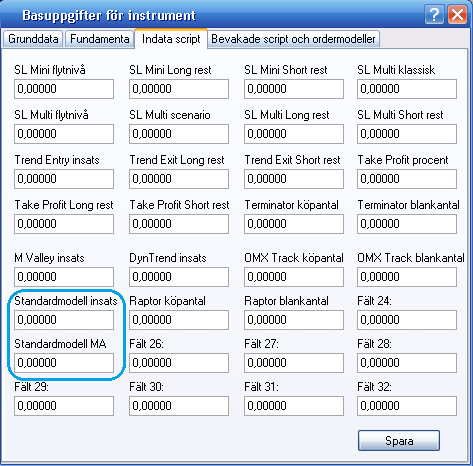

How to configure and connect the order models |

|

Two parameters are available to set individually for each instruments, the first one is the number of days to calculate the moving average, and the second one is the amount to invest. The investment size is used to calculate the number of shares to buy. Note that the investment should be entered in the currency in which the particular instrument is traded in.

|